‘The Gold Standard’. What was it? What happened to it? And, will it ever come back to Australia.

In this article we go back in time, to get a feel for how ‘The Gold Standard’ emerged, its steady decline and pose the question, will it ever come back?

What was The Gold Standard?

The true definition of the gold standard refers to a time when currency values were based on a set amount of gold, more specifically currencies backed by a Reserve Bank’s gold reserves.

Like many other countries at the time, Australia adhered to the gold standard in that the total amount of notes that banks could issue was limited by their gold reserves. Under the gold standard, money was ‘backed’ by gold and countries agreed to convert paper money into a fixed amount of gold. Currency was ‘pegged’ to the price of gold, and the theory was you could at any time exchange that money for gold.

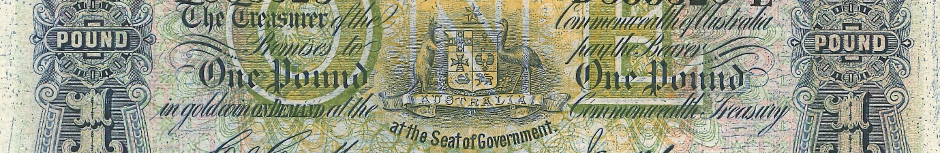

A 1913 Collins Allen One Pound Note with the emblazoned printed decree ‘The Treasurer of the Commonwealth of Australia, promises to pay the bearer, one pound in gold on demand at the Commonwealth Treasury’.

What happened to it?

Much of the literature surrounding The Gold Standard relates to the United States. We Australians have had a relatively fleeting relationship with currency tied to gold. All up, some sort of gold or silver backing lasted just over 100 years.

In 1910, legislation for a national currency was enacted. The Australian Government issued ‘superscribed’ banknotes, whereby words were overprinted on notes purchased from the private banks. These were the first currency notes accepted across the nation. The first official Australian Commonwealth banknote was produced in May 1913, the Collins Allen Ten Shillings with serial number M000001, with additional denominations produced from 1913 to 1915.

Australian currency continued to be backed by gold until 1932. Monetary policy from 1932 through to the 1970s had the currency pegged to the Pound Sterling, which at the time also stopped being backed by gold in 1931.

In 1966, Australia introduced the decimal currency system and changed the currency to the dollar. In 1967 the Australian dollar was then pegged to the US dollar. The Hawke-Keating Government in 1983 then ‘floated’ the dollar, making it freely able to ebb and flow on global exchange markets.

At present, no currencies in the world are backed by the gold standard, whereby consumers can hand in their currency for an equivalent piece of gold.

Would Australia ever go back onto the gold standard?

Before we tackle that question, let’s look at where we are now.

The gold standard meant that previously currency was actually based on something, which can be a relatively easy concept for most people to understand.

The virtual opposite of the gold standard is ‘fiat’ currency. Fiat currency is basically what all currency is based on nowadays, value based on exchange and nothing more than the promise that the government will do its job. Any money created is essentially done so ‘out of thin air’. In this way, fiat currency is generally more ‘elastic’. Even in moderate examples, such as here in Australia, the remit of many central banks is to adjust monetary policy to affect inflation.

We have lived in an era of fiat money since the early 1970s. Since then, virtually all money in existence has only had a value based on trust and, in particular, trust in governments’ ability to maintain its value. Prior to this period, most money in existence throughout history was backed by a commodity – usually a precious metal like gold or silver. Politically it is always too tempting to create money when nothing is backing it. For supporters of the gold standard, it appears we’re ‘too far gone’ to return to using it.

However, former international economist Nathan Lewis believes that gold was previously adopted as money because it works. And that the gold standard produced decades and even centuries of stable money and economic abundance. Lewis contests if history is to be used as a guide, we may indeed see the return of ‘The Gold Standard’ as a means of currency value stability, being based on a set amount of gold. Only time will tell.

For your further interest check out BBC4’s excellent ‘In Our Time’ podcast series hosted by Melvyn Bragg.

The podcast that explains the Gold Standard in detail can be found here – https://www.bbc.co.uk/sounds/play/m0013hh7

My sincere thanks to:

BBC4 for allowing me to share their podcast

And also to Harrison Astbury, Assistant Editor at Savings.com.au https://www.savings.com.au/ for allowing me to recreate in part his superb 2021 article on this fascinating subject.